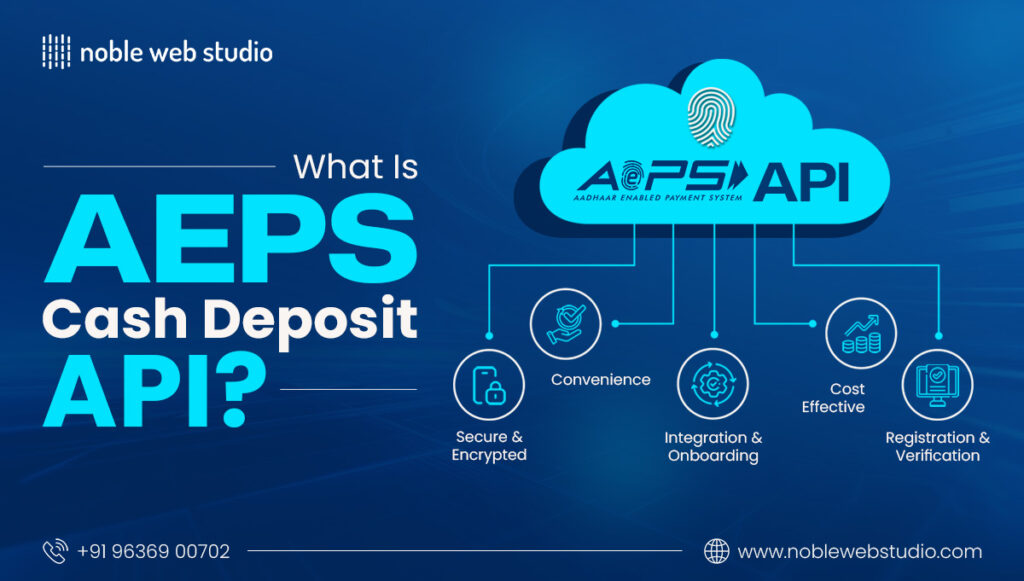

In today’s fast-growing digital economy, the AEPS Cash Deposit API has become a crucial tool for businesses, retailers, and fintech startups in India. This API allows you to offer Aadhaar-enabled cash deposit services directly to customers, making banking more accessible, fast, and secure. With the AEPS Cash Deposit API, retailers can accept deposits, manage customer accounts, and provide instant transaction updates without the need for traditional banking channels.

An AEPS (Aadhaar Enabled Payment System) Cash Deposit API lets businesses integrate basic banking functions, like depositing cash using just a customer’s Aadhaar number and fingerprint, into their apps or platforms, facilitating financial inclusion, especially in rural areas, via micro-ATMs and banking correspondents. It’s a secure, NPCI-backed service that simplifies banking by allowing paperless transactions, connecting users to their bank accounts for deposits, withdrawals, and balance checks. Providers like Noble web studio offer these APIs for seamless integration, making banking accessible to all.

For businesses and fintech companies, integrating a reliable AEPS Cash Deposit API ensures real-time settlements, multi-bank support, and smooth operation across rural and urban areas. This makes it an ideal solution for those looking to expand their digital financial services and earn commissions on every transaction.

With Noble Web Studio, you get a secure, scalable, and fully customizable AEPS Cash Deposit API that is designed for easy integration with your apps, B2B portals, or white-label platforms.

This guide will help you understand how AEPS Cash Deposit API works, its key features, benefits, and why it is a game-changer for retailers and businesses in India.

What is AEPS Cash Deposit API?

An AEPS (Aadhaar Enabled Payment System) Cash Deposit API is a software interface for businesses to integrate banking services, letting customers deposit cash using only their Aadhaar number and fingerprint for secure authentication, facilitating financial inclusion via micro-ATMs and BCs, and enabling real-time, paperless transactions managed by the National Payments Corporation of India (NPCI). Providers offer APIs for developers to embed functions like deposits, withdrawals, and balance checks into their own apps, connecting to the AEPS network for convenient, secure banking, especially in unbanked areas.

Read Blog : How to Start a Successful AEPS Business in India

AEPS Cash Deposit API Work

The AEPS Cash Deposit API enables businesses (merchants, retailers) to offer cash deposit services at their local outlets by linking a customer’s Aadhaar number to their bank account and using biometric authentication for secure transactions. It acts as a technical bridge between the merchant’s system and the central banking network.

How the AEPS Cash Deposit API Works

The process involves several steps facilitated by the API, which connects the various entities (merchant, bank, NPCI, UIDAI) in real-time:

- Transaction Completion & Confirmation: Upon successful verification, the bank processes the cash deposit into the customer’s account in real-time. A confirmation is sent back through the API to the merchant’s application. The customer receives an SMS confirmation and a transaction receipt.

- Customer Initiates Transaction: A customer with an Aadhaar-linked bank account visits a local merchant or banking correspondent location that offers AEPS services.

- Details Submission: The customer provides their Aadhaar number, mobile number, the name of their bank, and the amount to be deposited.

- Biometric Authentication: The merchant uses a UIDAI-certified biometric device (like a fingerprint scanner) to capture the customer’s fingerprint or iris scan. This is used for identity verification in place of a physical card or PIN.

- API Request: The merchant’s application, using the integrated AEPS API, sends the transaction details and the encrypted biometric data to the AEPS network via their Noble web studio.

- Verification and Processing: The request is routed through the National Payments Corporation of India (NPCI) network to the customer’s bank. The bank verifies the Aadhaar number and biometric data against records at the Unique Identification Authority of India (UIDAI).

Who Can Use AEPS Cash Deposit API

Businesses and organizations like banks, banking correspondents, fintech startups, and payment service providers can use the AEPS Cash Deposit API to enable their customers to perform transactions like cash deposits, withdrawals, and balance inquiries through Aadhaar authentication. This technology allows for a wide range of entities to provide basic banking services, particularly in areas with limited traditional banking access.

Entities that can use the AEPS API

- Banks: To extend their services to more customers, especially in rural areas.

- Banking Correspondents: Appointed by banks to provide financial services where physical branches are unavailable.

- Fintech Startups: To build innovative financial solutions and serve the unbanked and underbanked populations.

- Payment Service Providers: To offer a variety of services, including cash deposits, through their platforms.

- Retail Merchants: To act as banking points, attract more customers, and earn commissions on transactions.

- Microfinance Institutions: To facilitate the collection of loan repayments and other payments.

- Insurance and Pension Disbursement Agencies: To collect premiums and disburse benefits.

- E-commerce and Online Marketplaces: To integrate financial services into their platforms.

Who can use the service through the API

- Indian citizens: Anyone with a valid Aadhaar number linked to a bank account can use the services enabled by the API.

- Customers: They use the service at micro-ATMs or authorized agents to perform banking transactions, such as cash deposits, through biometric authentication.

Benefits of Using AEPS Cash Deposit API

The AEPS (Aadhaar Enabled Payment System) Cash Deposit API offers significant benefits for both businesses (like retailers and fintechs) and customers, primarily by promoting financial inclusion and providing a secure, convenient, and cost-effective way to access essential banking services.

Benefits for Businesses and Service Providers

- New Revenue Streams: Businesses, such as local kirana stores or banking correspondents, can earn commissions on every cash deposit transaction and other AEPS services they facilitate, creating a stable additional income source.

- Increased Customer Footfall and Loyalty: Offering convenient banking services turns a local shop into a mini-banking point, attracting more customers. This increased foot traffic can also lead to increased sales of the business’s primary products and services, fostering customer loyalty and trust.

- Cost-Effective Infrastructure: Integrating the AEPS API is more affordable than establishing a traditional bank branch or ATM, requiring minimal investment in infrastructure (typically just a smartphone/computer and a certified biometric device).

- Expanded Market Reach: The API allows businesses to serve unbanked and underbanked populations, particularly in rural and remote areas where traditional banking access is limited, thereby expanding their customer base.

- Seamless Integration: The API is designed for easy integration into existing applications or platforms, with clear documentation and support from AEPS API providers like Noble web studio, allowing for a quick go-live process.

- Operational Efficiency: The system supports real-time, paperless transactions, which streamlines financial operations and reduces manual errors.

Benefits for Customers

- Convenience and Accessibility: Customers can deposit cash at a nearby retail outlet without having to travel long distances to a physical bank branch or ATM.

- Financial Inclusion: It brings essential banking services to people in remote areas, empowering those who were previously financially excluded to access formal banking channels.

- Security: Transactions are highly secure, relying on Aadhaar-based biometric authentication (fingerprint or iris scan) to verify the customer’s identity, which reduces the risk of fraud associated with stolen cards or forgotten PINs.

- Paperless and PIN-Free: The system eliminates the need for physical debit cards, PINs, or extensive paperwork, simplifying the banking experience.

- Instant Processing: Cash deposits are processed in real-time, with immediate SMS confirmation, ensuring quick access to funds.

- Access to Government Benefits: The system facilitates the secure and direct deposit and withdrawal of government subsidies, pensions, and other welfare payments into Aadhaar-linked accounts (Direct Benefit Transfers).

The AEPS Cash Deposit API thus serves as a vital tool in India’s digital finance ecosystem, making banking services more democratic and accessible.

Read Blog : Top Advanced Security Features of AEPS Transactions You Should Know

Features AEPS Cash Deposit API

An AEPS (Aadhaar Enabled Payment System) Cash Deposit API allows merchants and businesses to offer customers a secure way to deposit physical cash into their bank accounts using Aadhaar-based biometric authentication (fingerprint/iris) instead of cards or PINs, enabling instant, paperless transactions, promoting financial inclusion, and integrating with various platforms for real-time processing and multi-bank support. Key features include Aadhaar/biometric verification, instant confirmation, 24/7 availability, and seamless integration for easy banking access in remote areas.

Core Features of AEPS Cash Deposit API

- Aadhaar-Based Biometric Authentication: Uses a customer’s Aadhaar number and fingerprint/iris scan for secure identity verification, eliminating the need for cards or PINs.

- Real-Time Processing: Transactions are processed instantly, providing immediate confirmation to the customer and merchant.

- Paperless & PIN-Free: A convenient, cardless, and PIN-free method for banking.

- Multi-Bank Interoperability: Works across various banks linked to the Aadhaar system.

- Financial Inclusion: Extends banking services to unbanked populations, especially in rural areas.

- Merchant-Friendly Integration: Easily integrates into existing business apps or platforms via an API.

- SMS Confirmation & Receipts: Customers receive instant transaction confirmation via SMS and proof of deposit.

- Security: Employs encryption and system-level checks for secure data transmission.

Integration of AEPS Cash Deposit API

To integrate an AEPS Cash Deposit API, you must first choose a Noble web studio, register your business, and complete KYC verification. After registering your compliant biometric device and obtaining the API keys and documentation, you integrate the API into your application and test it thoroughly in a sandbox environment before going live.

1. Select a provider and register your business

- Choose a provider: Select an authorized AEPS service provider, such as Noble Web Studio.

- Register your business: Complete the registration process with Noble web studio.

- Complete KYC: Submit necessary documents to complete the Know Your Customer (KYC) verification process.

2. Acquire hardware and API credentials

- Obtain biometric device: Acquire and register an RD Service-compliant biometric device (like a fingerprint scanner).

- Get API credentials: After successful registration and verification, the provider will provide you with the API keys and integration documentation.

3. Integrate and test the API

- Integrate the API: Use the provided API to connect the AEPS Cash Deposit functionality to your application, website, or POS system.

- Test in sandbox: Thoroughly test the integration in the Noble web studio test or sandbox environment to ensure it works correctly before deployment.

4. Go live

- Go live: Once testing is complete, deploy the integrated system to the live environment to start offering cash deposit services to your customers.

Commission Structure and Revenue AEPS Cash Deposit API

The commission for an AEPS cash deposit API is tiered, with earnings increasing with the transaction amount, such as around ₹2 for transactions between ₹100-₹999 and up to ₹9 for ₹3000 transactions. This commission is a share of the interchange fees set by the National Payments Corporation of India (NPCI). Besides the commission, revenue for the platform provider can come from the interchange fee split, while retailers also earn commissions for facilitating transactions like cash deposits, withdrawals, balance inquiries, and fund transfers.

How the commission is structured

- Tiered commission: Retailers earn more commission for higher-value transactions.

- For example, a transaction between ₹100 and ₹999 might earn ₹2, while a ₹3,000 transaction could earn around ₹9.

- Share of interchange fees: The commission is a portion of the interchange fee that is split between banks, private companies, distributors, and retailers.

- Additional revenue streams:

- Platform providers: May earn revenue from the interchange fee split and by charging a fee to retailers for using the platform.

- Retailers: Earn commissions on various AEPS services, including cash deposits, withdrawals, balance inquiries, and fund transfers.

- Customer charges: Retailers may charge customers an additional service fee for using AEPS, though this may be limited by regulations.

Other factors

- Provider variation: Commission rates and slabs can differ depending on the AEPS provider or platform you choose.

- Bonuses: Some providers offer bonuses or incentives for agents who achieve high transaction volumes, creating additional earning potential.

- Role-based commission: Distributors or master distributors earn a share of the commissions generated by the retailers they manage.

Benefits of the API for businesses

- New revenue stream: Allows businesses, especially retailers, to earn additional income through transaction commissions.

- Increased foot traffic: Offering AEPS services can attract more customers to a business’s physical location.

- Wider customer reach: Enables serving a larger customer base, including those with limited access to traditional banking.

White Label AEPS Cash Deposit Solutions

White label AEPS cash deposit solutions allow businesses to offer Aadhaar-enabled payment system (AEPS) services, including cash deposits, under their own brand name by using a pre-built and customizable software platform from a provider. These solutions are ideal for fintech startups as they eliminate the need for custom software development, provide a ready-made system with your own branding, and include features like biometric authentication for secure transactions.

Choosing the Right AEPS Cash Deposit API Provider in India

Noble web studio is the right AEPS cash deposit API provider, prioritize NPCI and RBI compliance and robust security. Next, evaluate the provider’s reliability by checking for high transaction success rates and uptime, and ensure they offer multi-bank support. Finally, consider factors like integration ease, cost-effectiveness, and responsive customer support.

1. Security and Compliance

- NPCI and RBI certification: Verify the Noble web studio is certified by the National Payments Corporation of India (NPCI) and adheres to Reserve Bank of India (RBI) guidelines.

- Data security: Look for strong security measures like end-to-end encryption, secure login, and fraud prevention.

2. Reliability and Performance

- High transaction success rate: Choose a Noble web studio with a proven track record of a high success rate (ideally 98%+) and low failure rate.

- Uptime and stability: Ensure the Noble web studio has a stable API infrastructure with high uptime to avoid service interruptions.

3. Features and Functionality

- Core services: Confirm the API supports all essential services, including cash deposit, cash withdrawal, and balance inquiry.

- Multi-bank support: Select a provider that supports a wide network of banks to provide greater flexibility for your customers.

- Real-time processing: Check for real-time transaction processing and settlement for faster cash flow management.

4. Integration and Usability

- Seamless integration: Look for a well-documented API that can be easily integrated into your existing systems, like mobile apps or POS terminals.

- User-friendly interface: The API should support an intuitive and user-friendly interface for both agents and customers.

5. Support and Cost

- 24/7 customer support: Responsive and reliable technical support is crucial for resolving issues quickly.

- Transparent pricing: Understand the complete cost structure, including any licensing fees, transaction charges, and commission models.

Why Noble Web Studio is a Trusted AEPS Cash Deposit API Provider

Noble web studio is a trusted AEPS Cash Deposit API provider because it uses biometric authentication for secure transactions, complies with RBI and NPCI regulations, and protects user data through strong security measures like encryption. These Noble web studio also offer reliable, scalable platforms with features like multi-bank support, real-time processing, and comprehensive customer support.

Security and compliance

- Biometric authentication: Transactions are secured through Aadhaar-linked fingerprints or iris scans, which makes them highly resistant to fraud.

- Regulatory adherence: The Noble web studio is authorized by the National Payments Corporation of India (NPCI) and follows guidelines from the Reserve Bank of India (RBI).

- Data encryption: Strong security measures, including data encryption, are used to protect user data and financial transactions from unauthorized access.

Reliability and performance

- High success rates: A trusted Noble web studio will have a high transaction success rate and low downtime, ensuring services are consistently available.

- Real-time processing: Transactions are processed in real-time, providing quick and efficient service to users.

- Multi-bank support: The API is integrated with multiple banks, allowing for interoperability across a wide network.

Service and support

- Scalable platform: The API is built to handle a large volume of transactions, allowing it to scale with your business needs.

- Easy integration: Comprehensive documentation makes it easy to integrate the API into existing applications or platforms.

- 24/7 support: Round-the-clock customer support is available to assist with any issues.

Read Blog: What Are The Advantages and Disadvantages of AePS in 2025?

Future Scope of AEPS Cash Deposit Api

The future scope of the Aadhaar Enabled Payment System (AEPS) Cash Deposit API is highly promising, driven by continued efforts toward financial inclusion and technological advancements in India’s digital economy. Key trends indicate significant growth, enhanced security, and deeper integration with the broader digital ecosystem.

Key Future Trends

- Deeper Integration with the Digital Ecosystem: AEPS APIs will increasingly integrate with other digital payment platforms such as the Unified Payments Interface (UPI) and Bharat Bill Payment System (BBPS). This convergence will create multi-service platforms, allowing users to perform a wider array of financial transactions (like utility bill payments and mobile recharges) from a single interface.

- Enhanced Security and Fraud Prevention: The future will see the implementation of more robust security measures. This includes leveraging Artificial Intelligence (AI) and Machine Learning (ML) to analyze transaction patterns and detect fraud in real time. Regulatory bodies like the Reserve Bank of India (RBI) are also mandating stricter KYC (Know Your Customer) processes and enhanced monitoring of AEPS operators to curb fraudulent activities effectively.

- Advanced Biometric Technology: Biometric authentication will evolve beyond traditional fingerprint and iris scans. Future enhancements may include voice and facial recognition to improve transaction speed, convenience, and security, especially in cases where fingerprints might be unclear.

- Mobile-First Solutions and Improved User Experience: With the rise in smartphone penetration, there will be a strong focus on developing user-friendly, mobile-first AEPS applications for both customers and agents. This will include intuitive interfaces and multi-language support to cater to diverse populations and improve accessibility.

- Integration with E-commerce and Value-Added Services: The scope of AEPS will expand beyond basic banking. AEPS APIs are expected to facilitate payments for e-commerce, micro-loans, and insurance premium collections, further solidifying their role in everyday financial activities.

- Blockchain Technology Adoption: The potential use of blockchain is being explored to provide a more transparent and tamper-proof ledger for transactions, which would enhance overall security and build greater customer confidence in the system.

- Continued Focus on Financial Inclusion: AEPS will remain a cornerstone for extending banking services to unbanked and underbanked populations in rural and remote areas. The low-cost, minimal-infrastructure model will continue to be vital for the direct disbursement of government benefits and subsidies, ensuring they reach the intended beneficiaries securely and efficiently.

The AEPS Cash Deposit API will play a crucial role in transforming local retail outlets into comprehensive mini-banking hubs, driving both financial inclusion for millions and new revenue streams for businesses across India.

Conclusion: Why Choose AEPS Cash Deposit API by NobleWebStudio?

The AEPS Cash Deposit API is a game-changer for retailers, distributors, and fintech businesses looking to provide secure, fast, and Aadhaar-enabled banking services. By integrating this API, businesses can enable customers to deposit cash directly into their bank accounts using just their Aadhaar number, without the need for traditional bank visits.

An AEPS (Aadhaar Enabled Payment System) Cash Deposit API is a software tool that allows businesses to integrate cash deposit services into their own applications, enabling customers to deposit cash into their bank accounts using only their Aadhaar number and biometric authentication. This API connects the business’s point-of-sale (POS) or micro-ATM device to the bank network via the National Payments Corporation of India (NPCI), allowing for secure, card-less cash deposits.

For businesses, this solution not only enhances customer convenience but also creates new revenue streams through transaction commissions. Retailers and startups can benefit from real-time settlements, multi-bank support, and robust security features, making their financial services more reliable and trusted.

Choosing a reliable AEPS API provider like Noble Web Studio ensures you get a scalable, secure, and fully customizable solution with white-label options, multi-bank support, and real-time reporting. Whether you are expanding your digital financial services or starting a new fintech venture, the AEPS Cash Deposit API can help you grow your business, serve more customers, and stay ahead in India’s digital banking ecosystem.

Integrating the AEPS Cash Deposit API is a smart move for businesses aiming for efficiency, security, and higher earnings in digital financial services.

FAQ Section:

Ans. AEPS (Aadhaar Enabled Payment System) Cash Deposit API is a solution that enables merchants to provide cash deposit services to customers using Aadhaar and biometric authentication. This service facilitates easy, secure deposits into bank accounts without the need to visit a bank branch.

Ans. The AEPS Cash Deposit API allows customers to visit merchant outlets, authenticate themselves using their Aadhaar number and biometric verification, and deposit cash into their bank accounts. The merchant processes the transaction using the AEPS system, ensuring instant, secure deposits.

Ans. Merchants, retail store owners, and businesses can integrate the AEPS Cash Deposit API into their systems to offer cash deposit services. Customers who wish to deposit money into their bank accounts can use this service, especially in areas with limited access to traditional banking facilities.

Ans. Merchants benefit from offering AEPS Cash Deposit services by attracting more customers, earning transaction commissions, enhancing customer trust, and providing essential banking services without the need for expensive infrastructure.

Ans. Yes, AEPS Cash Deposit API is highly secure, with biometric authentication and encrypted transactions to ensure the safety of both the customer’s and merchant’s data. All transactions are processed with the utmost security to prevent fraud.

Ans. To integrate AEPS Cash Deposit API, merchants need to register with a service provider like NobleWebStudio, purchase compatible biometric devices, and integrate the AEPS API into their existing point-of-sale (POS) systems or mobile applications. NobleWebStudio offers seamless integration support.

Ans. While NobleWebStudio charges a nominal fee for integration and API usage, merchants can earn commissions on each transaction processed through AEPS Cash Deposit services. The fee structure varies based on the volume of transactions and the agreements made with the service provider.

Ans. Yes, AEPS Cash Deposit services can be offered 24/7, provided that the merchant’s outlet has the required infrastructure (internet connection, biometric devices) and stable power supply. This allows customers to make deposits at any time of day or night.

Ans. Yes, AEPS Cash Deposit API supports multiple banks across India. Customers can deposit money into accounts held at different banks as long as they are registered with the AEPS system.

Ans. The transaction limits for AEPS Cash Deposit depend on the customer’s bank and regulatory guidelines. These limits vary, and it’s important to check with your service provider or the bank for specific transaction limit details.