Noble web studio offers best Micro ATM service with software, mobile app and Micro ATM devices. Best part of Micro ATMs are best commission on cash withdrawal, portable device, easy to use. Micro ATM devices accept all bank cards and biometrics secure transaction for cash withdrawal.

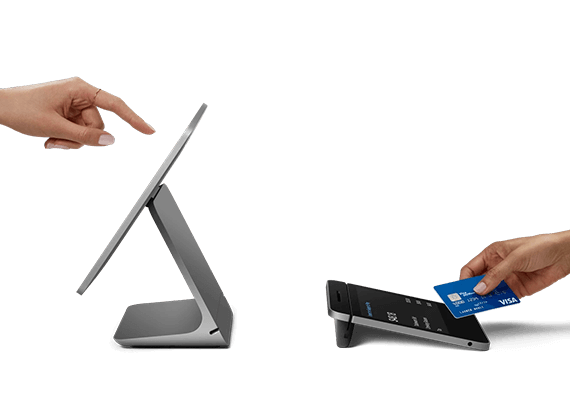

Micro ATMs are card swipe machines through which banks can remotely connect to their core banking system. This machine comes with a fingerprint scanner attached to it. In other words, micro ATMs are handheld point of sale terminals used to disburse cash in remote locations where bank branches cannot reach. Micro ATMs are similar to point of sale (PoS) terminals and are a doorstep mobile banking arrangement cum-mobile ATM device. But Bank provide best commission on each withdrawal through Micro ATM.

Micro ATMs aim to bridge this growing need gap by allowing users to carry out essential financial transactions by empowering local retailers and kirana store owners with these devices. The AEPS systems empower even the most marginalized and underserved Indians, bringing the convenience of thumb-print enabled transactions at their doorstep.

Micro ATMs are similar to point of sale (PoS) terminals and are a doorstep mobile banking arrangement cum-mobile ATM device. But Bank provide best commission on each withdrawal through Micro ATM.

Micro ATMs are a mini version of an ATM. Micro ATMs are point of sales terminals which can connect to banking network to perform banking transactions through GPRS connctivity. The micro ATMs are best for carrying out cash transactions easily in situation when ATMs are running dry or ATMs are so far or not available. They are developed with features like point of sales (POS), connecting banking networks through GPRS for carrying bank-related transactions. Equipped with card swipe facility, the Micro ATMs can even operate via fingerprint scanner or card swipe facility. Generally, these mini ATMs are situated in remote or mobile locations.

These machines are carried by bank representative (Shopkeeper, retailer) at remote/mobile locations. These machines are handy, portable and not capable of keeping any cash. The cash is carried by the bank representative along with him/her. He/She is also responsible for collecting a cash and depositing it user account.Among the benefits these Micro ATMs are that they are portable devices, have low cost option, biometric related secure transaction and also have low-cost features.

Aadhaar Enabled Payment Systems and Micro ATM devices allow essential financial transactions such as Cash Withdrawal and Balance Enquiry. Users can swipe their debit cards on the machine and withdraw the respective amount of cash. Balance enquiry through a secure PIN/ID based system can also be done. Through its focused efforts, The Micro ATM is invented to help people of the rural area for the financial inclusion. However, in heavy shortage of cash problem Micro ATM machines can provide benifits to everyone.

Key Benefits of Micro ATM

- Micro ATM is low cost option then ordinary ATM.

- Portable

- Easy to carry

- Easy to setup

- Connectivity through GSM

- Biometric enabled secured transactions

- Interoperable device and can work for any bank

- Best Commision

- Quick Withdrawal

- Quick Balance Enquiry

- No need to go ATM and facing queue.

- Secure

Micro ATMs perform following transactions

- Cash Deposit

- Cash Withdrawal

- Fund Transfer

- Balance Enquiry

- Service Request acceptance

- Aadhar Seeding

- eKYC based saving account opening

Bank will assign a correspondent who will sign up customers in remote areas after verifying their identity by Fingureprint or Aadhar no (fingerprint can be used as an authentication tool for rural people).The fingerprint and personal details may also be linked to the Aadhaar Card, which will then serve as the ID proof required to withdraw money.

To operate this portal, a person has to undergo verification process such as Aadhaar card with fingerprint scanning or card swipe option. Once verified, he or she will be able to select options for various transactions like - cash deposit, fund transfer, eKYC based saving account, Aadhaar seeding, cash withdrawal, balance enquiry and service request acceptance. For carrying a transaction all you have to do is select the option as per your requirement, then a message will be displayed on the screen and print receipt is generated. After the transaction, a person will as usual receive confirmation from their bank about the transaction via SMS.

- Verification process - For the Verification process, Aadhaar card with fingerprint scanning or card swipe option is provided.

- Once verification is completed Micro ATM will display various transaction options.

- Select transaction type and device will process the transaction.

- On successful transaction, a message will be displayed on the screen and print receipt is generated.

- You will also get SMS alert from your bank about the transaction.

- Best Noble Software and Mobile APP with your Own Brand Name

- Customized Reporting

- You can use Micro ATM with web and app by Noble Software

- Attractive commission on every transaction

- Secure

- Portable

- Quick Transaction

- E Receipt (Electronic Slips)

- Services through direct Bank.

- Free support

- Micro ATM Devices on Best price

- Accept all cards, UPI

- Portable, compact, wireless terminals

- Notifications and Reports

- Works with your existing bank account

Noble Web Studio offers to start your services with noble software with your own brand name and logo. Noble offers multi services like - micro atm, microatm devices, aeps, bbps, money transfer, recharge, bill payment, travel - (bus, flight, hotel), shopping, sms(transaction and promotional) longcode service and many more services. Any one can easily start own business with own brand name and logo. We provide fully customized software with free android application.

Customised software means - you can integrate any api or service in future. fully customized reporting. you can also change software design in future.

Micro atm, aeps and money transfer are banking services. These services are directly from bank.