In today’s digital banking ecosystem, having a secure and reliable AePS portal is essential for businesses, retailers, and financial service providers. AePS (Aadhaar Enabled Payment System) allows users to perform cash withdrawals, balance inquiries, and money transfers quickly and securely using Aadhaar authentication, making it a vital tool for financial inclusion in India.

A Secure AePS Portal (Aadhaar Enabled Payment System) is a digital platform allowing basic banking (cash withdrawal, deposit, balance check) using just Aadhaar and biometrics (fingerprint/iris), facilitated by the NPCI and India’s government for financial inclusion, acting as a secure link between bank accounts and service points via biometric authentication to ensure safety and interoperability.

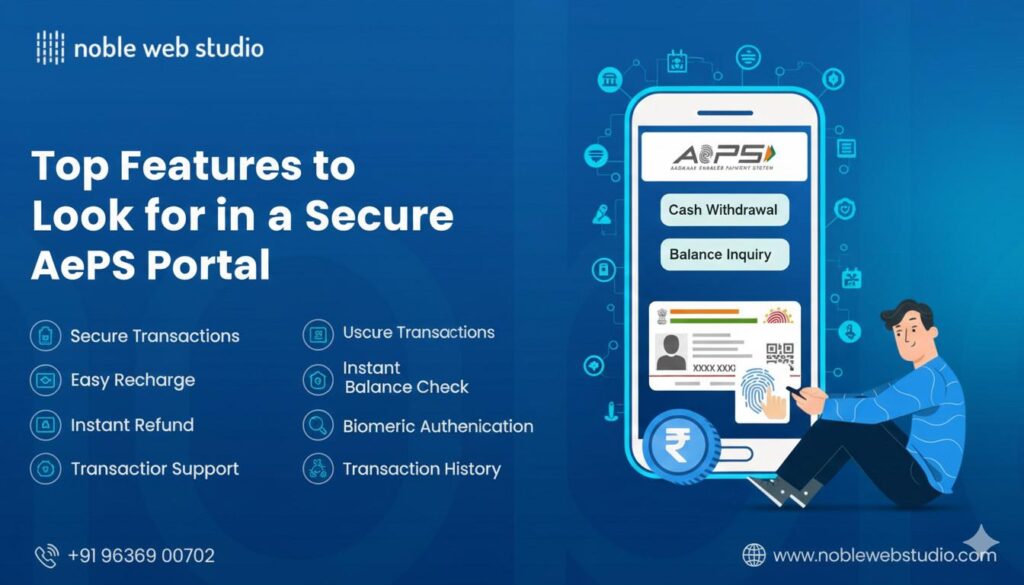

When selecting an AePS portal, businesses should look for multi-bank support, real-time transaction processing, secure Aadhaar authentication, user-friendly dashboards, advanced reporting, and 24/7 technical support. These features ensure smooth operations, increase customer trust, and maximize revenue opportunities.

Choosing the right AePS portal ensures not only secure transactions but also smooth operations, real-time processing, and seamless integration with digital payment solutions. A robust aeps portal empowers businesses to offer fast and trustworthy services, enhance customer satisfaction, and comply with regulatory standards.

At Noble Web Studio, we provide feature-rich and secure AePS portal solutions that combine reliability, high security, and easy usability.

This blog explains the top features you should look for to choose the best and most secure AePS portal for long-term success and high growth.

What Is an Secure AePS Portal

A secure AEPS (Aadhaar Enabled Payment System) Portal uses Aadhaar and biometrics (fingerprint) for authentication, eliminating PINs and cards, making it inherently secure as it links directly to your bank via NPCI, offering services like cash withdrawal, balance inquiry, and fund transfers at agent points. Key security features involve strong identity verification through biometrics, bank-led models, and interoperability, with portals focusing on robust aeps admin software dashboards, real-time settlements, and support for major banks to ensure safety for agents and customers.

Secure AePS Portal Work

A secure AePS portal is an online platform that enables basic, interoperable banking transactions using an individual’s Aadhaar number and biometric (fingerprint or iris) authentication. This system, developed by the National Payments Corporation of India (NPCI), promotes financial inclusion, especially in rural and unbanked areas, by allowing local agents to act as micro-ATMs.

How a Secure AePS Portal Works

The AEPS system connects different entities to facilitate secure, real-time transactions. The process involves:

- Initiation: A customer provides their Aadhaar number, bank name, and transaction type (like withdrawal or balance inquiry) to an agent with an AEPS device.

- Biometric Authentication: The customer provides their fingerprint or iris scan for verification against the UIDAI database.

- Transaction Processing: After successful authentication, the request goes to the customer’s bank via NPCI for account and balance checks.

- Completion: The transaction is processed, and the customer receives confirmation.

Who Can Use Secure AePS Portal

Anyone with an Aadhaar-linked bank account can use the general aadhaar enabled payment system software for basic banking at micro-ATMs or Banking Correspondent (BC) points, needing only their Aadhaar & biometrics; while businesses/aeps software for agents use a specific Secure AEPS Portal to offer these services, requiring KYC, biometric devices, and a shop, facilitating banking for others, especially in rural areas.

For Customers (End-Users)

- Indian Citizen: Must be an Indian national.

- Aadhaar-Linked Bank Account: Have an active bank account linked to their Aadhaar number.

- Biometric Data: Possess a registered fingerprint or iris scan with Aadhaar.

- Access Points: Use a micro ATM or BC point.

For Businesses/Agents (Using the Portal)

- Age: At least 18 years old.

- Documents: Valid Aadhaar, PAN card, address proof.

- Bank Account: An Aadhaar-linked bank account for settlements.

- Mobile: A functional mobile number.

- Location: A shop/kiosk in a rural or underserved area is often preferred.

- Equipment: A UIDAI-certified biometric device and necessary Aeps software.

- KYC: Complete Know Your Customer (KYC) process with the Noble web studio.

Top Use Cases of Secure AePS Portal

A secure Aadhaar Enabled Payment System (AePS) portal is primarily used to provide essential, accessible, and secure banking services to a wide population, especially in rural and unbanked areas of India.

Top use cases of a secure AePS portal include:

For Customers and Financial Inclusion

- Cash Withdrawal and Deposit: Individuals can easily withdraw or deposit cash at local retail points (micro-ATMs) without having to visit a distant bank branch or traditional ATM.

- Balance Inquiry and Mini Statements: Users can instantly check their bank account balance and view a summary of their recent transactions using only their Aadhaar number and biometric authentication.

- Fund Transfers: The system facilitates secure interbank and intrabank money transfers between Aadhaar-linked accounts.

- Direct Benefit Transfer (DBT) Disbursement: The government uses AePS to transparently and efficiently disburse subsidies, pensions, and other welfare scheme payments directly to beneficiaries’ accounts, bypassing middlemen.

- Accessibility: AePS provides banking access to individuals with minimal digital literacy or those who do not own smartphones, debit cards, or remember PINs, using only biometric identity verification.

For Businesses and Merchants

- Becoming a Micro-ATM: Retailers and local shop owners can transform their outlets into mini-banking service points, attracting more customers and increasing foot traffic.

- New Revenue Streams: Businesses earn commissions on every transaction they facilitate through the portal, creating a profitable additional income source.

- Aadhaar Pay: Merchants can use BHIM Aadhaar Pay to accept cashless payments from customers directly into their accounts via biometric authentication for goods and services.

- eKYC Services: AePS software provides a real-time, paperless method for identity verification, which is a key component for onboarding customers for other financial services like microfinance and insurance.

- Utility Bill Payments and Recharges: Many secure Aeps portal integrate additional services such as mobile recharges and utility bill payments (electricity, gas, water) through the Bharat Bill Payment System (BBPS).

Why Businesses Need a Secure AePS Portal

Businesses need a secure AEPS (Aadhaar Enabled Payment System) portal to create new income streams via commissions, boost customer footfall and loyalty by offering essential banking (withdrawals, deposits) in rural areas, enhance security with biometrics, and align with India’s digital economy, all while reducing costs compared to traditional banking setup and promoting financial inclusion. A secure Aeps admin portal ensures trust, manages agents, tracks transactions, and offers scalability for growth.

Key Benefits for Businesses:

- New Revenue Streams: Earn commissions on transactions (cash-in/out, mini statements, balance checks).

- Increased Footfall & Sales: Attract more customers to your physical store for banking, leading to more product/service sales.

- Financial Inclusion: Serve unbanked/underbanked populations in remote areas, bridging the urban-rural gap.

- Cost-Effective Banking: Offer banking services without the huge investment of ATMs or bank branches.

- Enhanced Security: Biometric authentication (fingerprint) minimizes fraud and builds customer trust.

- Customer Convenience: Provide essential banking at the doorstep, saving customers time and effort.

- Digital India Alignment: Support government initiatives for a cashless, digital economy.

Security & Operational Advantages:

- Fraud Reduction: Biometric verification prevents unauthorized access, unlike PINs/cards.

- Operational Efficiency: Manage agents, monitor performance, and handle transactions digitally through the portal.

- Scalability: Aeps Platforms can handle growing transaction volumes, supporting business expansion.

- Reliability: Secure portals offer high uptime and success rates for transactions, ensuring smooth operations.

A secure AEPS portal transforms local shops into digital banking points, creating value for the business, the customer, and the broader financial ecosystem.

Benefits Secure AePS Portal

A Secure AEPS Portal brings basic, cardless banking to rural India, offering financial inclusion, convenience, and security by letting users do cash withdrawals, deposits, and balance checks using just their Aadhaar & fingerprint at local agents. It cuts travel, enables direct government subsidy delivery, boosts security via biometrics, and creates income for agents, all securely managed through NPCI.

For Users (Citizens)

- Financial Inclusion: Access banking in remote areas without needing bank branches or ATMs.

- Convenience: No need for debit cards or remembering PINs; use Aadhaar & biometrics.

- Security: Biometric (fingerprint/iris) authentication reduces fraud risk.

- Services: Cash withdrawal, deposit, balance inquiry, mini-statements, and Aadhaar-to-Aadhaar transfers.

- Government Benefits: Receive direct benefit transfers (DBT) easily.

For Businesses/Agents/Retailers

- New Revenue: Earn commissions on transactions, creating income streams.

- Increased Footfall: Attract more customers to their shops.

- Expanded Reach: Offer essential digital services in underserved communities.

- Simplified Operations: Manage agents and monitor transactions through a single portal.

Features Secure AePS Portal

A secure AEPS (Aadhaar Enabled Payment System) portal offers core banking services like cash withdrawal, deposit, balance inquiry, and fund transfer, leveraging Aadhaar for biometric (fingerprint/iris) authentication for secure, interoperable access to bank accounts, promoting financial inclusion by enabling transactions via agents in remote areas, with features like real-time monitoring, strong encryption, and fraud detection for enhanced safety.

Core Banking Features

- Cash Withdrawal/Deposit: Withdraw or deposit cash using Aadhaar at agent locations.

- Balance Inquiry & Mini Statement: Check account balance and get recent transaction details.

- Fund Transfer: Transfer money between Aadhaar-linked accounts (Aadhaar-to-Aadhaar).

Security Features

- Biometric Authentication: Uses Aadhaar number with fingerprint or iris scan for secure login.

- Encryption: Encrypts sensitive transaction data during transmission.

- Fraud Detection: Systems to identify and prevent suspicious activities.

- Multi-Factor Authentication: Combines Aadhaar with other factors for stronger security.

Portal & Operational Features

- Interoperability: Works across different banks, allowing customers to use any bank’s services.

- Agent Management: Dashboards for agents and aeps admin to manage transactions and earnings.

- Reporting & Analytics: Detailed reports on transactions, settlements, and commissions.

- Scalability: Ability to handle growing transaction volumes.

- Customization: White-labeling options for businesses to brand the portal.

Steps to Aeps API Integration

Integrating AEPS API into your platform involves several key business and technical steps, as direct integration with the National Payments Corporation of India (NPCI) is not possible.

Business and Legal Steps

- Choose a Certified AEPS API Provider: Select a reputable, NPCI-certified Noble web studio that offers the AEPS API, as they act as the bridge to the national banking network. Evaluate Noble web studio based on reliability, security, documentation quality, and commission structures.

- Register and Complete KYC: Sign up with the Noble wbe studio provide platform and complete the mandatory Know Your Customer (KYC) verification process. This typically requires submitting documents such as:

- Aadhaar card

- PAN card

- Bank account details (for commission settlement)

- Business registration documents (if applicable)

- Acquire and Register a Biometric Device: Purchase a UIDAI-certified biometric device (fingerprint or iris scanner) that is compatible with Noble wbe studio provide platform. You must also install the manufacturer’s Registered Device (RD) service aadhaar enabled payment system software

- to ensure secure data capture.

Technical and Integration Steps

- Obtain API Credentials and Documentation: Once your registration and KYC are verified, the Noble wbe studio will supply Aeps API keys, access tokens, and comprehensive technical documentation outlining the best Aeps API endpoints, request/response formats (e.g., JSON), and security protocols.

- Integrate the AEPS API: Your aeps software development team will integrate Aeps API into your best Aeps software, website, or Point-of-Sale (POS) system. This involves:

- Test in a Sandbox Environment: Thoroughly test all transaction types (cash withdrawal, balance inquiry, mini statement, etc.) in the Noble web studio secure sandbox environment. This stage is crucial for identifying and resolving issues before going live with real money transactions.

- Go Live and Monitor: After successful testing and compliance checks, transition the integrated Aeps api solution to the live production environment using your production credentials. Continuously monitor performance, manage settlements, and provide customer support.

Secure AePS Portal Cost

The cost for a secure AEPS (Aadhaar Enabled Payment System) portal varies widely in India, from a few thousand rupees for basic Aeps setups to much more for custom aeps solution provider, generally involving one-time Aeps setup fees (₹12k-₹35k), aeps banking software costs (₹15k-₹1L+), a biometric device (~₹20k), and ongoing transaction Aeps commission/support fees, with white-label options offering branding at a premium. Expect costs for basic Aeps API or white-label Aeps portal, plus hardware, integration, and transaction-based charges.

Cost Breakdown:

- Setup Fees (One-Time): ₹12,000 – ₹35,000 for initial integration and configuration.

Software/Portal:

- Basic/API: ₹15,000 – ₹1,00,000+ for standard Aeps software.

- White-Label: ₹25,000 – ₹1.2 Lakhs for pre-branded solutions.

- Biometric Device: Around ₹20,000 for a scanner.

Ongoing Costs:

- Transaction Fees: Commissions (e.g., 0.5-1%) or flat fees per transaction.

- Support/Hosting: Monthly or annual charges.

- GST & Bank Charges: Applicable taxes and potential bank fees.

Key Factors Influencing Cost:

- Solution Type: Standard Aeps API integration is usually cheaper than a fully branded white label Aeps portal.

- Features: More features (multi-bank, fund transfers, mini-statements) increase costs.

- Provider: Costs differ significantly between vendors; get quotes.

You pay for setup, the Aeps software platform, essential hardware, and a share of transaction revenue, making the total investment variable.

Secure AePS Portal Commission Structure

Secure AEPS portal commission structures typically use tiered slabs, paying agents more for higher transaction values, like ₹2 for ₹100-₹999 and up to ₹13+ for ₹3000+ withdrawals, plus smaller fees for Balance Inquiries (₹2-₹5) and Mini Statements (₹3-₹7), varying by provider like Noble Web Studio. Commissions are earned for facilitating cash withdrawals, deposits, balance checks, and fund transfers, increasing agent income while promoting financial inclusion.

Typical Commission Structure (Example)

- ₹100 – ₹999: ~₹2 per transaction

- ₹1,000 – ₹1,499: ~₹3 per transaction

- ₹1,500 – ₹1,999: ~₹4.5 per transaction

- ₹2,000 – ₹2,499: ~₹5.5 per transaction

- ₹3,000 and above: Up to ₹13 or more

Other Services

- Balance Inquiry: ₹2 – ₹5 per transaction

- Mini Statement: ₹3 – ₹7 per transaction

- Aadhaar to Aadhaar Fund Transfer: ₹5 – ₹10 per transaction

Key Factors Influencing Commissions

- Transaction Value: Higher amounts yield better returns.

- Service Type: Different aeps software service have different rates.

- Provider: Rates and structures vary between platforms Noble Web Studio.

- Volume Incentives: Noble Web Studio offer bonuses for high transaction counts.

How to Choose the Right AePS Portal Provider

Noble web studio is the right AEPS portal provider, prioritize NPCI/RBI compliance & security, check for high transaction success rates & reliability, ensure a user-friendly platform & seamless integration, compare transparent commission & costs, and verify the availability of strong 24/7 support & multi-bank services for a robust, scalable, and trustworthy platform.

Key Factors to Consider:

Regulatory Compliance & Security

- NPCI/RBI Certification: Essential for legitimacy and adherence to security standards; verify directly.

- Data Encryption: Look for SSL encryption (padlock icon) and strict privacy policies (no Aadhaar data storage).

- Biometric Security: Ensure the system only uses Aadhaar for authentication, passing data to UIDAI servers.

Reliability & Performance:

- Transaction Success Rate: Aim for 98%+ for consistent service.

- Minimal Downtime: Choose aeps software development company like Noble web studio known for stability.

Features & Services:

- Multi-Bank Support: Access various banks through one portal.

- Value-Added Services: Check for bill payments, mobile recharges, etc..

- User-Friendly Interface (UI): Intuitive for both you and your customers.

- Admin Panel: Robust management for agents, transactions, and disputes.

Support & Integration:

- 24/7 Technical Support: Responsive and reliable help for issues.

- Seamless Integration: API options for your existing systems.

Cost & Commission:

- Transparent Pricing: Clear commission structures and licensing fees.

Reputation:

- Reviews & Testimonials: Check third-party sites for user experiences.

By thoroughly evaluating these aspects, you can select an AEPS provider like Noble web studio that aligns with your business needs, ensuring secure, efficient, and profitable service delivery.

Why Choose Noble Web Studio for AePS Portal Solutions

Noble web studio is an AEPS portal provider for secure, fast, and scalable digital banking services, offering cash withdrawal, balance checks, etc., to promote financial inclusion and create new revenue streams via commissions, relying on strong security, user-friendly interfaces, real-time support, and seamless integration with existing systems for retailers, agents, and fintechs.

Key Reasons to Choose a Provider:

- Financial Inclusion & Reach: Offers essential banking to underserved rural areas, boosting customer trust and expanding your business.

- New Revenue Streams: Earn commissions from every transaction (cash withdrawal, balance inquiry).

- Security & Trust: Uses secure Aadhaar biometric authentication (fingerprint/IRIS) for fraud reduction.

- High Performance: Look for fast transaction processing, high success rates, and 99.9% uptime.

- User-Friendly Experience: A simple, intuitive interface for agents and customers is crucial.

- Multi-Bank Support: Supports transactions across many different banks for broad customer convenience.

- Reliable Support: Access to 24/7 customer service (chat, call, WhatsApp) for quick issue resolution.

- Scalability: A robust platform that can grow with your business needs.

- Seamless Integration: Easy-to-integration Aeps API for existing AEPS B2B Software or white label Aeps portal setup.

- Transparent Pricing: Clear commission structures and pricing without hidden fees.

- Value-Added Services: Noble web studio often offer mobile recharge, bill payments, and more for extra income.

Future Trends Secure AePS Portal

Future trends for secure AEPS portals focus on AI/ML for fraud, advanced biometrics (face/iris), blockchain for transparency, deeper ecosystem integration (UPI/BBPS), expanded services (loans/insurance), and mobile-first UX, transforming them into comprehensive digital micro-banks with stronger encryption and real-time monitoring for better security and financial inclusion in India.

Key Security Trends

- AI & Machine Learning: Real-time fraud detection, anomaly identification, and risk assessment for smarter security.

- Advanced Biometrics: Moving beyond fingerprints to facial and iris scans for more secure and faster authentication.

- Blockchain: Creating immutable, transparent transaction ledgers to reduce fraud and increase trust.

- Stronger Encryption: Implementing advanced encryption for greater data protection.

Enhanced Functionality & Integration

- UPI & BBPS Integration: Seamless linking with other major digital payment systems.

- Expanded Services: Offering micro-loans, insurance, bill payments, and mobile recharges beyond just cash.

- Mobile-First Design: User-friendly, accessible apps for wider adoption, especially in rural areas.

- API-First Architecture: Easier integration with CRMs and other applications for scalability.

Operational Improvements

- Real-Time Processing & Settlement: Faster, more efficient transactions.

- Robust Admin Panels: AI-powered dashboards for better monitoring and management.

- Multi-Level User Management: Better controls for businesses and agents.

Overall Goal

- Deeper Financial Inclusion: Turning local shops into comprehensive financial hubs for the unbanked.

Conclusion

Choosing a secure AePS portal is crucial for businesses that want to offer reliable and seamless Aadhaar-enabled banking services. A robust portal with features like biometric authentication, real-time transactions, AEPS integration, and secure payment processing ensures that users can perform cash withdrawals, balance inquiries, and fund transfers safely and efficiently.

A Secure AEPS Portal is an online platform for the Aadhaar Enabled Payment System, allowing retailers/agents to offer basic banking (cash withdrawal, balance check, fund transfer) using Aadhaar & biometrics (fingerprint/iris) for secure, interoperable transactions via NPCI, linking to customer bank accounts, crucial for financial inclusion and Direct Benefit Transfers (DBT). Security relies on multi-factor authentication (Aadhaar + biometrics) against fraud, with portals offering features like real-time settlement and aeps admin panels for management.

By selecting a trusted AePS portal provider like Noble Web Studio, businesses can deliver secure, fast, and user-friendly services while promoting financial inclusion in both rural and urban areas. The right portal only enhances operational efficiency but also boosts customer trust, revenue growth, and compliance with RBI guidelines.

Noble Web Studio provides a feature-rich and reliable AePS portal that meets all these requirements. With easy-to-use dashboards, Aadhaar Enabled Payment System API integration, secure data encryption, and 24×7 customer support, retailers and entrepreneurs can grow their AePS business with confidence.

Investing in a feature-rich and secure AePS portal is essential for businesses looking to expand their digital banking solutions and provide safe, accessible, and seamless financial services to all users.

FAQs – Top Features to Look for in a Secure AePS Portal

An AePS (Aadhaar Enabled Payment System) Portal is a digital platform that allows businesses and retailers to provide secure banking services like cash withdrawals, balance checks, and money transfers using Aadhaar authentication.

Security ensures that all transactions are safe, reliable, and fraud-free, protecting both customers and businesses from unauthorized access and financial risks.

Real-time transaction processing

Biometric authentication with Aadhaar

Cash withdrawal, balance inquiry, and mini statements

AEPS and wallet integration

User-friendly dashboard for easy management

High uptime and technical support

Banks, fintech companies, micro-entrepreneurs, and local retailers can use an AePS Portal provide digital banking services in rural and urban areas.

Biometric authentication verifies identity through fingerprints, making transactions safe, accurate, and fraud-proof.

AePS enables financial inclusion by allowing remote users to access banking services without needing a bank branch. It empowers local businesses to offer secure, instant digital payments.

Multi-bank support allows users to access services from multiple banks, providing faster transactions, better availability, and higher success rates.

Yes. Retailers, CSC centers, and small businesses use AePS portals to offer cash withdrawal, mini statements, and balance checks, earning commissions per transaction.

Look for a Noble web studio that offers strong security, real-time transaction support, wallet integration, and reliable customer service. Noble Web Studio provides all these features with customizable solutions.

Yes. A secure AePS Portal can integrate with wallets, digital payment platforms, and banking APIs to offer a seamless experience for businesses and customers.

Real-time processing gives instant results, improves user satisfaction, and reduces the chances of failed transactions.

Yes. AePS portal designed for safe Aadhaar-based banking and are widely used in rural, semi-urban, and remote areas where traditional banking access is limited.

Businesses can partner with a trusted aeps software service provider like Noble Web Studio, complete KYC, and integrate the service to start offering banking features instantly.

Noble Web Studio offers a secure, fast, customizable, and fully compliant AePS b2b portal with strong security, real-time processing, and multi-bank integration.