How AEPS API Helps Startups Grow Their Digital Payment Business

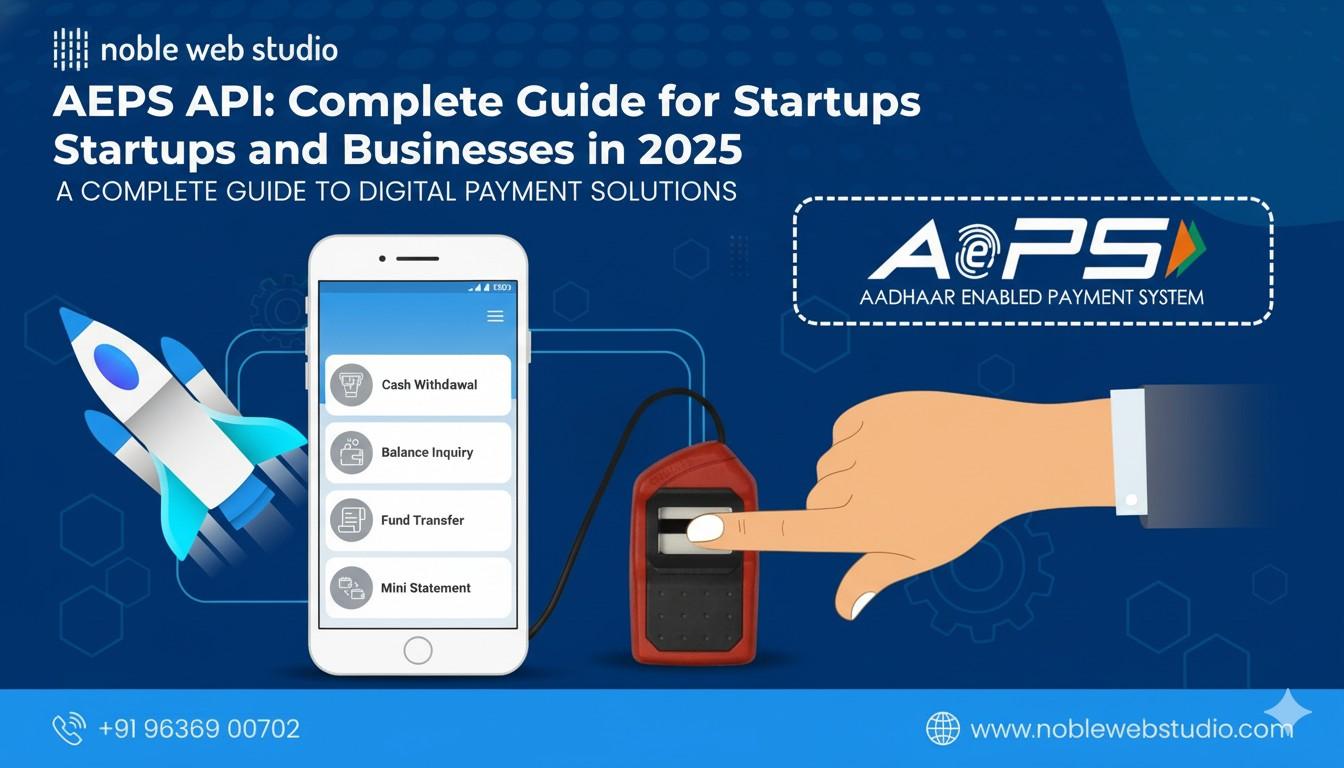

In today’s fast-growing digital economy, startups are constantly looking for secure and efficient ways to offer financial services. The AEPS API (Aadhaar Enabled Payment System API) has become one of the most powerful tools for startups entering the digital payment industry. It allows businesses to provide essential banking services like cash withdrawal, balance inquiry, and … Read more