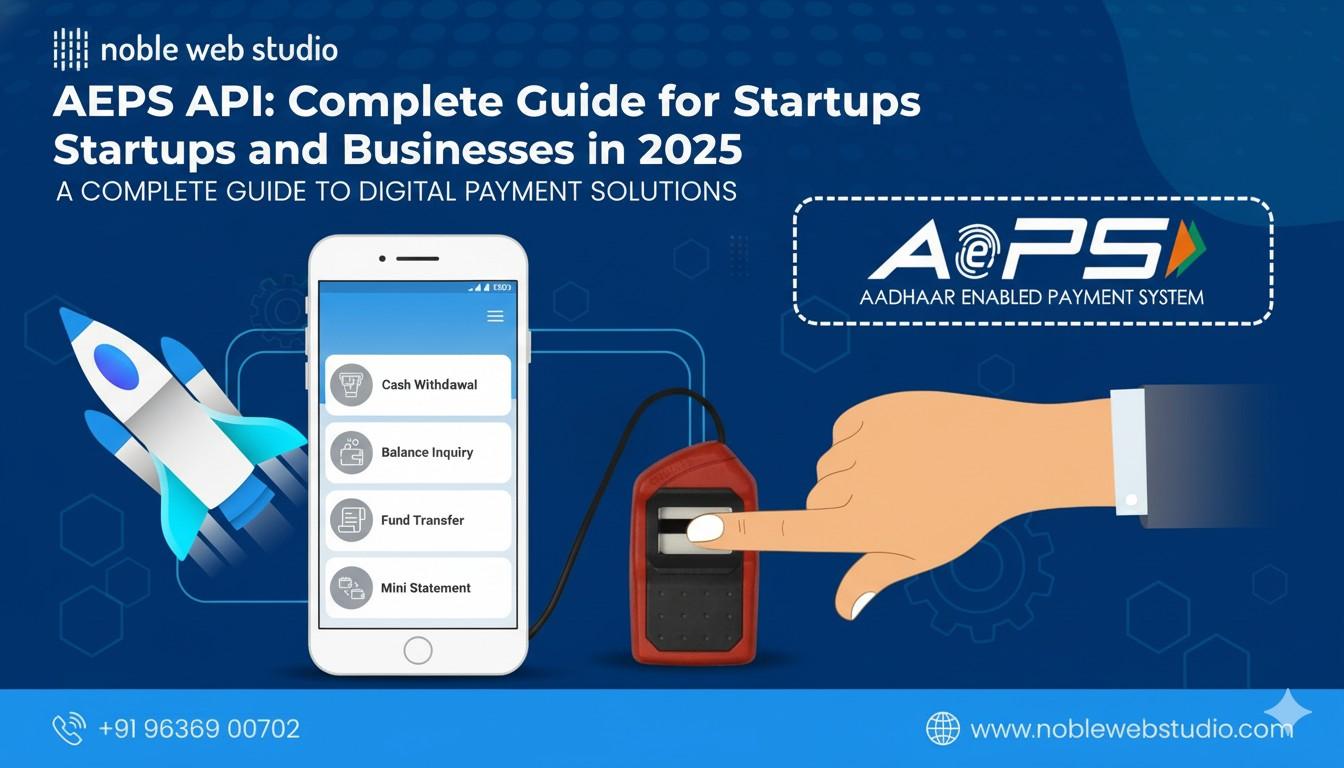

AEPS API Solution for Retailers and Businesses

In today’s digital world, retailers and businesses need fast, secure, and reliable solutions to process Aadhaar-based transactions. AEPS API solutions make this possible by allowing businesses to offer services like cash withdrawal, balance enquiry, mini statements, and Aadhaar-enabled payments seamlessly. With the growing demand for digital financial services in India, having a robust AEPS API … Read more