Why Your Business Needs an AEPS API in 2026

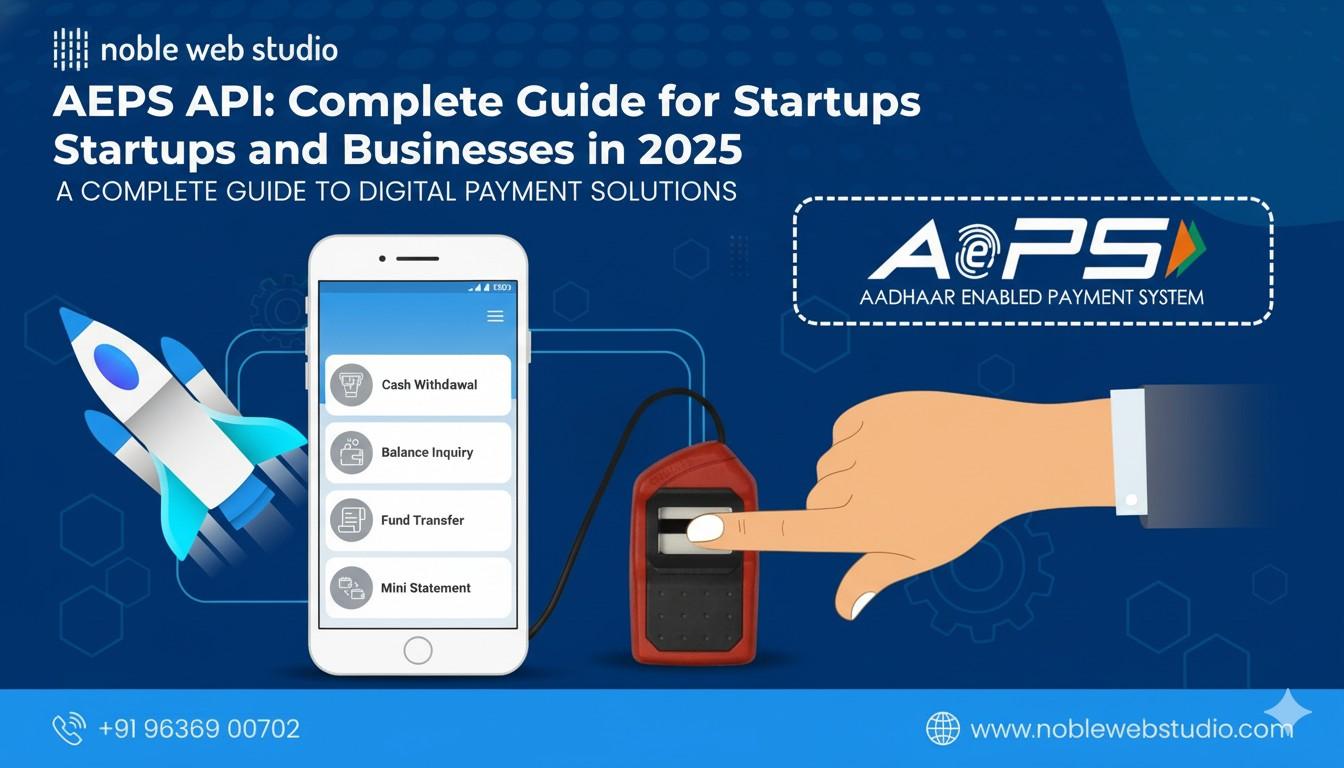

In today’s digital-first world, offering fast, secure, and convenient financial services has become essential for every business. The Aadhaar Enabled Payment System (AEPS) is transforming the way people access banking by allowing users to perform cash withdrawals, balance inquiries, and money transfers using just their Aadhaar number and fingerprint. For businesses, this means new opportunities … Read more