What to Look for in the AEPS API Provider in India

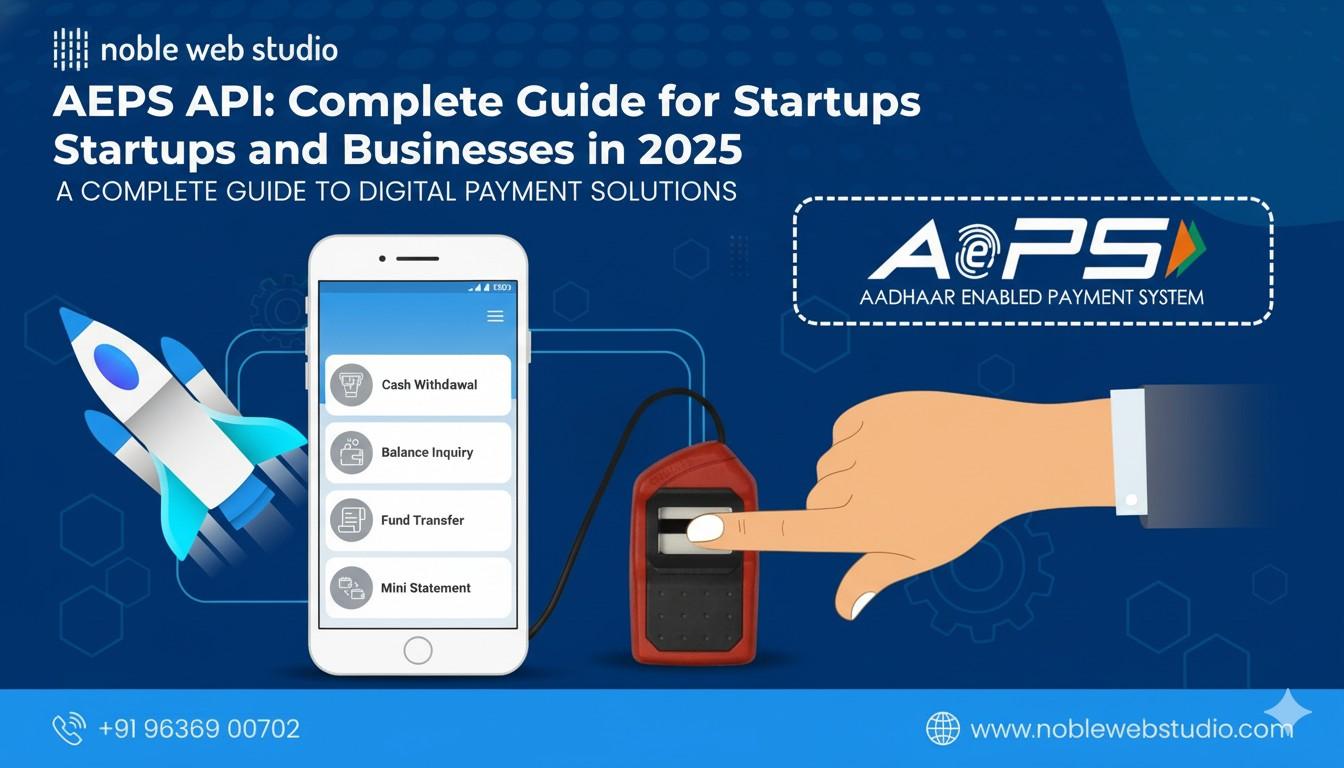

In today’s fast-growing digital payment ecosystem, AEPS (Aadhaar Enabled Payment System) APIs have become essential for retailers, distributors, and fintech businesses in India. These AEPS retailer API allow seamless Aadhaar-based transactions, including cash withdrawals, balance checks, mini statements, and money transfers, directly through apps, websites, or Aeps B2B portal. Noble web studio is an AEPS … Read more