In 2026, digital payment solutions continue to reshape the way businesses operate, and AEPS API Aadhaar Enabled Payment System API is at the center of this transformation. AEPS allows users to withdraw cash, check balance, and make payments using just their Aadhaar number and biometric authentication making financial transactions faster, safer, and more accessible, especially in rural and semi-urban areas.

An AEPS API (Aadhaar Enabled Payment System Application Programming Interface) is a Aeps B2b software tool that allows businesses to integrate basic banking services, such as cash withdrawals and balance inquiries, into their own platforms. It connects a business’s system to the AEPS network, enabling customers to perform transactions using their Aadhaar number and biometric authentication, effectively turning the business’s location into a micro-ATM.

For startups and businesses, integrating AEPS API opens new revenue streams by enabling secure, real-time banking services like cash withdrawal, deposit, and fund transfers directly from their platforms. It not only helps companies serve a wider audience but also builds trust and customer loyalty through seamless financial services.

At Noble Web Studio, we help startups and enterprises integrate reliable AEPS API solutions designed for scalability, compliance, and smooth user experience.

This complete guide will help you understand how AEPS APIs work, their benefits, setup process, and how they can help your business grow in 2026.

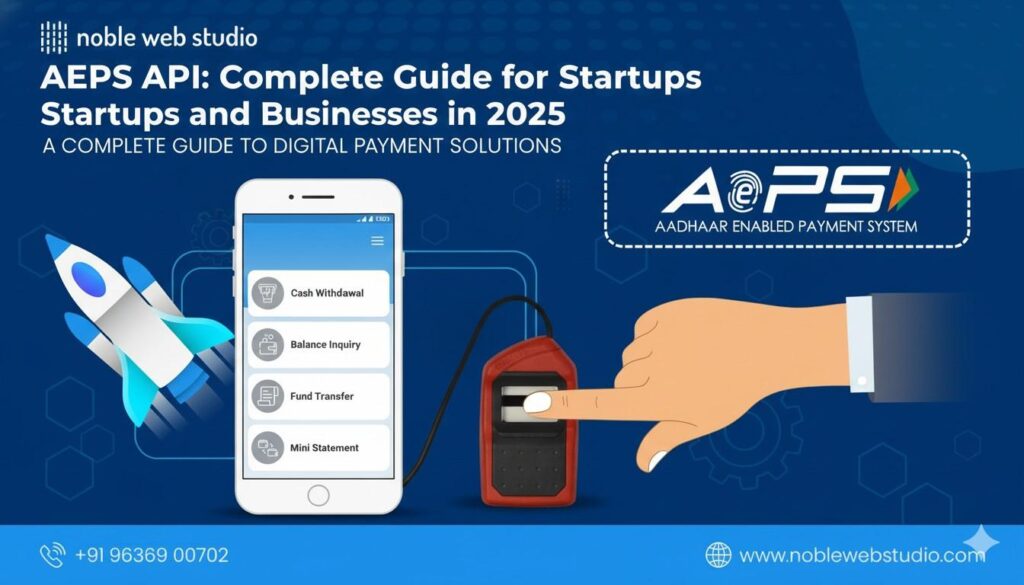

What is AEPS API

An AEPS API (Aadhaar Enabled Payment System Application Programming Interface) is a software tool that allows businesses to integrate basic banking services into their own applications and platforms. It enables customers to perform transactions like cash withdrawals, deposits, and balance inquiries using only their Aadhaar number and a fingerprint for biometric authentication, typically at a micro-ATM. This promotes financial inclusion by connecting customers to their bank accounts through a Business Correspondent.

Services offered

- Cash withdrawal and deposit

- Balance inquiry

- Fund transfer

- Mini statement

- BHIM Aadhaar Pay

AEPS API Work

An AEPS Aadhaar Enabled Payment System API works by connecting a business’s point-of-sale (PoS) device or application to the NPCI network, allowing customers to perform basic banking transactions using only their Aadhaar number and biometrics. The API securely sends the transaction request, which includes the customer’s details, to the network for verification with the bank and the UIDAI. If authentication is successful, the API processes the transaction, such as a cash withdrawal or balance inquiry, in real-time.

How the AEPS API works

- User initiates a transaction: A customer provides their Aadhaar number and authenticates themselves using a fingerprint scan at a merchant’s device or micro-ATM.

- API receives and transmits the request: The merchant’s application, integrated AEPS API, sends the transaction request to the NPCI network.

- Bank and UIDAI verification: The Fast Aeps API facilitates the verification of the customer’s identity by connecting with the customer’s bank and the UIDAI database to validate the Aadhaar number and biometric data.

- Transaction processing: If the verification is successful, the best Aeps API processes the transaction, such as a cash withdrawal, balance inquiry, or fund transfer, in real-time.

- Confirmation is sent: The Aeps API provides confirmation of the successful transaction back to the customer and the merchant.

Read Blog : AEPS API Integration: Step-by-Step Guide for Businesses in 2025

Top Function of AEPS API

The function of an AEPS (Aadhaar Enabled Payment System) API is to allow businesses to integrate basic banking services, such as cash withdrawal, deposit, fund transfers, and balance inquiries, into their own applications or micro ATM devices. By using Aadhaar number and biometric authentication, the API enables secure and convenient financial transactions for customers, particularly in remote or underserved areas.

Core functions enabled by the AEPS API

- Cash withdrawal and deposit: Facilitates cash transactions at merchant locations, acting as a micro-ATM.

- Balance inquiry: Allows customers to check the balance of their Aadhaar-linked bank account.

- Mini-statement generation: Provides a short statement of recent transactions in the account.

- Fund transfers: Enables both interbank and Aadhaar-to-Aadhaar fund transfers.

- Aadhaar authentication: Uses biometric data to securely verify the customer’s identity.

- BHIM Aadhaar Pay: Supports payment services through the BHIM Aadhaar Pay platform.

Top Use Cases of AEPS API in 2025

In 2025, top use cases for AEPS (Aadhaar Enabled Payment System) API include rural banking services through micro-ATMs, disbursement of government subsidies, and enabling secure, cashless payments for small merchants. Other key uses are providing essential banking functions like cash withdrawal, deposit, balance inquiry, and fund transfers, which helps financial inclusion in unbanked areas and offers new payment options for businesses.

Primary use cases

- Rural and financial inclusion: AEPS API are crucial for bringing banking services to remote and unbanked populations by enabling retailers and AEPS Software for Agents to provide services like cash withdrawals, deposits, and balance inquiries through micro ATM.

- Government benefit distribution: They provide a secure and efficient way for the government to disburse funds directly to beneficiaries through schemes like Direct Benefit Transfer (DBT), reducing leakage and ensuring timely access to funds.

- Micro-merchant payments: Small businesses and retailers can accept secure, cardless payments from customers using just their Aadhaar number and biometrics, facilitating a cashless economy in rural areas.

Core banking functions

- Cash Withdrawal and Deposit: Customers can withdraw cash from their Aadhaar-linked bank accounts, or deposit cash directly into them, at agent touchpoints.

- Balance Inquiry and Mini Statement: Users can check their bank account balance and view recent transaction history using their Aadhaar and biometrics.

- Fund Transfer: The Aeps API facilitates secure money transfers between Aadhaar-linked bank accounts, even across different banks.

Other business applications

- Fintech and e-commerce: Noble web studio can integrate AEPS into their platforms to quickly offer a wide range of banking services, while e-commerce businesses can use it to provide more secure, biometric payment options.

- Loan repayments: Microfinance institutions can use the system to collect loan repayments from members via biometric authentication at agent points, streamlining operations.

Why AEPS API is Important for Startups and Businesses

AEPS (Aadhaar Enabled Payment System) APIs are important for startups and businesses because they enable financial inclusion by providing basic banking services in areas with limited traditional infrastructure, which allows businesses to create new revenue streams through commissions. The Aeps API also helps attract more customers and expand market reach, while offering secure and convenient biometric-based transactions that build customer trust.

For startups and businesses

- New revenue streams: Businesses can earn commissions on transactions like cash withdrawals, deposits, and balance inquiries, providing a stable income source.

- Increased customer traffic: The ability to offer essential banking services acts as a draw for more customers, which can lead to increased sales of other products.

- Expanded market reach: Businesses can serve the unbanked and underbanked populations in rural and remote areas, particularly those without easy access to traditional banks.

- Reduced infrastructure costs: They can offer banking services with minimal investment in infrastructure compared to opening a physical branch.

- Enhanced customer engagement: Providing convenient services builds customer loyalty and trust, and can be integrated into existing platforms for better service offerings.

For financial inclusion

- Access for rural and unbanked populations: Best AEPS API allows businesses to provide essential financial services to customers who may lack access to traditional banking channels.

- Convenient, cardless transactions: Customers can perform transactions like cash withdrawals and deposits using just their Aadhaar number and fingerprint, without needing debit cards, PINs, or passwords.

- Secure biometric authentication: The system uses Aadhaar-based biometrics to ensure secure and authenticated transactions, protecting both the customer and the business.

- Access to government subsidies: It provides a convenient and cost-effective way for governments to disburse subsidies and welfare programs directly to citizens.

Read Blog : Step-by-Step Guide to AEPS API Service for Businesses

Benefits AEPS API

The benefits of an AEPS API include improved financial inclusion, enhanced security through biometric authentication, and increased convenience for customers. For businesses, it offers new revenue streams and the ability to integrate banking services into their platforms, while for users, it provides secure and easy access to banking services like cash withdrawal, balance inquiry, and fund transfers, especially in rural areas.

For businesses

- Expanded customer base: Businesses can reach unbanked and underserved populations, particularly in rural areas, by integrating basic banking services into their existing platforms.

- New revenue streams: Merchants earn commissions on every transaction, creating a new source of income.

- Support for financial inclusion: By enabling access to financial services for those who lack them, businesses can play a role in promoting financial inclusion.

- Easy integration: The Aeps API designed to be easily integrated Aeps platform, such as POS machines and mobile applications.

- Increased efficiency: Streamlines banking processes and provides real-time transaction processing, leading to greater efficiency.

For users

- Financial inclusion: Provides access to banking services for individuals in remote areas who may not have easy access to a traditional bank or ATM.

- Enhanced security: Transactions are secured using Aadhaar-linked biometric data, such as fingerprint authentication, which helps prevent fraud and unauthorized access.

- Convenience: Eliminates the need for debit cards, PINs, and passwords. Users can simply use their Aadhaar number and biometrics for transactions like cash withdrawal and balance inquiries.

- Time-saving: Quick and easy access to banking services, which helps users avoid long queues at banks or ATMs.

- Real-time services: Allows for instant fund transfers and balance inquiries without delays.

Read Blog : Key Features to Look for in an AEPS API

Features AEPS API

AEPS (Aadhaar Enabled Payment System) API features include core banking services like cash withdrawal, balance inquiry, fund transfer, and cash deposit, all secured by biometric authentication. Key additional features are multi-bank support, real-time processing, secure data encryption, and mini-statement generation, along with easy integration into various business platforms like mobile apps and websites.

Core banking services

- Cash Withdrawal: Allows users to withdraw cash from their Aadhaar-linked bank accounts.

- Balance Inquiry: Enables users to check their bank account balance.

- Fund Transfer: Facilitates the transfer of funds between Aadhaar-linked bank accounts.

- Cash Deposit: Allows for the deposit of cash into Aadhaar-linked accounts.

- Mini Statement: Provides a summary of recent transactions from the account.

Security and reliability

- Biometric Authentication: Uses fingerprint or iris scans linked to Aadhaar for secure transaction verification, eliminating the need for debit cards or PINs.

- Secure Data Encryption: Protects sensitive financial data during transmission.

- Real-Time Processing: Ensures instant and efficient transaction processing.

- Fraud Detection: Employs system-level checks to prevent unauthorized access.

Integration and administration

- Multi-Bank Support: Works with multiple banks by integrating with the NPCI network.

- Easy Integration: Provides developer-friendly documentation and Aeps API integration into Aeps platforms.

- 24/7 Availability: Some services allow for transactions even outside of normal banking hours.

How AEPS API Helps Businesses Earn More Commission

AEPS (Aadhaar Enabled Payment System) API helps businesses earn more commission by enabling them to offer essential banking services and thereby generating new revenue streams and increasing customer engagement.

Here’s how AEPS API facilitates this:

- New Revenue Streams through Commissions: Businesses, particularly retailers acting as micro-ATM earn commission on every AEPS transaction they facilitate. This includes services like cash withdrawals, deposits, balance inquiries, and mini-statements. Each successful transaction contributes to a direct income source.

- Increased Customer Footfall: By offering convenient banking services, especially in areas with limited access to traditional banks, businesses attract a broader customer base. This increased foot traffic can lead to higher sales of their primary products or services, providing an indirect boost to revenue.

- Expanded Service Offerings: Integrate AEPS API allows businesses to expand their service portfolio beyond their core offerings. This enhances their value proposition to customers and makes them a more comprehensive Noble web studio, potentially leading to higher customer loyalty and repeat business.

- Financial Inclusion and Market Reach: Businesses can cater to the unbanked and underbanked populations, particularly in rural and semi-urban areas, by providing accessible banking services. This not only fulfills a social need but also expands the business’s market reach and customer base.

- Enhanced Customer Trust and Loyalty: Providing reliable and secure financial services through a trusted platform like AEPS builds confidence and trust among customers. This strengthens customer relationships and encourages long-term loyalty, which is vital for sustainable business growth.

- Cost-Effective Expansion: AEPS offers a budget-friendly way to introduce banking services without the significant investment required for setting up and maintaining physical bank branches or ATMs. This allows businesses to expand their service offerings and reach without incurring high operational costs.

Read Blog : AEPS API Portal: Step-by-Step Guide for Businesses

Step-by-Step Process to Integrate AEPS API

Integrating AEPS (Aadhaar Enabled Payment System) API snippets into an existing platform involves several key steps:

Select a Trusted AEPS API Provider:

- Identify a reliable AEPS API provider like Noble web studio registered with the National Payments Corporation of India (NPCI) and compliant with security standards.

- Evaluate Noble web studio based on Aeps API infrastructure, uptime guarantees, multi-bank support, real-time logging, RD device compatibility, and technical support.

Registration and KYC Completion:

- Register your business with the Noble web studio.

- Complete the Know Your Customer (KYC) verification process by submitting required documents such as Aadhaar card, PAN card, bank account details, and business verification documents if applicable.

Acquire and Set Up Biometric Device:

- Obtain an RD-service compliant biometric device (e.g., fingerprint scanner) necessary for capturing customer biometrics during transactions.

- Ensure the device is properly configured and integrated with your system according to the Noble web studio instructions.

Integrate the AEPS API:

- Access the AEPS API key, documentation, and any provided SDKs from Noble web studio.

- Integrate AEPS functionalities into your Aeps software, web portal, or Point-of-Sale (POS) system. This involves incorporating code snippets to handle various AEPS transactions like cash withdrawal, balance inquiry, and fund transfer.

- Utilize the provided Aeps API endpoints and data formats to send transaction requests and receive responses.

Enable AEPS Services and Testing:

- Activate the AEPS service for your retailers or merchants within your platform.

- Conduct thorough testing of the integrated AEPS Portal provider system in a sandbox or staging environment to ensure all functionalities work as expected and transactions are processed correctly.

Go Live:

- Once testing is complete and successful, deploy the integrated AEPS solution to your production environment.

- Begin offering AEPS services to your customers, ensuring compliance with all regulatory requirements.

Read Blog : Affordable AEPS API Providers in India for Startups

How Much Does AEPS API Cost

AEPS API costs vary widely, from a one-time setup fee of approximately ₹12,000 to ₹35,000, plus a recurring transaction commission of 0.5% to 1% (capped at ₹15) and potential Aeps software costs ranging from ₹35,000 to ₹1,00,000+ and the type of integration (proper vs. white label). For example, Noble web studio offer white label Aeps API services for around ₹15,000.

Cost breakdown

- Setup/Integration Fees:These can range from roughly ₹12,000 to ₹35,000.

- Transaction Fees:This is usually a commission charged on each transaction, often between 0.5% and 1%, with a maximum cap of around ₹15.

- Software Costs:The cost Aeps software itself can range from ₹35,000 to ₹1,00,000 or more, depending on the features.

- Software costs:

- Can be a one-time payment ranging from ₹25,000 to ₹60,000.

- Noble web studio offer Aadhaar Enabled Payment System software for around ₹35,000–₹50,000.

- Noble web studio may charge for annual fees instead.

Transaction fees:

- Usually a commission of 0.5% to 1% of the transaction amount.

- There may be a cap on the maximum fee per transaction (e.g., ₹15).

- An NPCI settlement fee of approximately ₹0.15–₹0.25 may also apply.

- White-label solutions: Noble Web Studio costs can range from ₹25,000 to ₹1.2 lakhs or more, depending on the selected features, customization, and service requirements.

- Other: Some services from trusted providers like Noble Web Studio prices as a flat fee per package, which can be around ₹30,000 or more, though these may not include all ongoing costs.

White-label vs. Proper API:

- A white label Aeps API can be significantly cheaper, with some options costing around ₹15,000 for services.

- A proper Aeps API, which offers more customization, is more expensive, with some quotes at ₹2,55,000.

Other potential costs:

- Licensing: Noble web studio may have a lifetime license fee.

- Support: Noble web studio offer free integration support, ongoing support costs may vary.

Factors that influence the cost

- Provider: Noble web studio have best pricing structures.

- Integration type: Choose between a white label Aeps solution or a more customize Aeps API.

- Bank integration: The cost may vary depending on the number and type of banks you want to integrate.

- Features: Advanced features and higher transaction volumes will likely increase the cost.

Earn High Commissions with AEPS API

You can earn high commissions with an AEPS API by integrating it into your business to provide services like cash withdrawals, deposits, and balance inquiries, which generate revenue per transaction. The commission earned varies by Noble web studio and transaction volume, with cash withdrawals typically earning the highest commissions, which can go up to ₹13 or more per transaction for large amounts. To maximize earnings, focus on high-value transactions, promote the service to attract more customers, and consider offering additional services like bill payments to boost income.

How to earn commission

- Focus on cash withdrawals: This is the most lucrative transaction type, with commissions increasing as the transaction amount increases.

- Choose the right provider: Look for Noble web studio that offer competitive commission rates for different transaction slabs, some of which can reach over ₹13 per transaction.

- Increase transaction volume: To earn more, attract more customers. By becoming a banking point, you can increase foot traffic, leading to more overall AEPS transactions and potential sales for your primary business.

- Offer additional services: Expand your income streams by providing other services like bill payments, mini statements, and mobile recharges through your AEPS portal.

Potential commission structure (example)

- ₹100 – ₹999: Around ₹2 per transaction.

- ₹1,000 – ₹1,499: Around ₹3 per transaction.

- ₹1,500 – ₹1,999: Around ₹4.5 per transaction.

- ₹2,000 – ₹2,499: Around ₹5.5 per transaction.

- ₹3,000 and above: Noble web studio offer up to ₹13 or more per transaction.

Factors to consider

- Provider choice: Noble web studio have different commission structures. Choose one that offers high commissions and reliable service.

- Transaction value: Understand the commission tier structure of your provider to know how much you can earn per transaction.

- Service quality: A fast, secure, and reliable Aeps API will improve customer experience and loyalty, leading to more business.

Additional benefits

- Increased foot traffic: Offering AEPS services can attract more customers to your shop, potentially leading to sales of other products and services.

- Revenue diversification: This provides an additional stream of income in addition to your primary business.

- Financial inclusion: You become a part of India’s financial inclusion initiative by providing essential services to your local community.

Read Blog : Boost Your Digital Payment Business with AEPS API Integration

Hire Professional AEPS API Developers

Hiring AEPS API developers involves finding individuals or teams with expertise in integrating Aadhaar Enabled Payment System (AEPS) functionality into your existing platforms or developing Aeps Software that leverage AEPS. This process typically requires developers with a strong understanding of best Aeps API integration, secure authentication protocols, and potentially mobile Aeps software development.

Key considerations when hiring AEPS API developers:

- API Integration Expertise: Developers should be proficient in consuming and external top Aadhaar Enabled Payment System API integration, including handling data formats, authentication mechanisms (like API keys), and error handling.

- Security and Compliance: AEPS involves sensitive financial transactions and personal data. Developers must have a strong understanding of security best practices, data encryption, and compliance with relevant regulations (e.g., PCI DSS if handling card data alongside AEPS).

- Biometric Device Integration: AEPS relies on biometric authentication. Developers should have experience integrating with STQC-certified biometric devices (e.g., fingerprint scanners) and their associated SDKs or drivers.

- Platform Specifics: Depending on your existing infrastructure, developers might need expertise in specific programming languages (e.g., Java, Python, Node.js), frameworks, and database technologies.

- UI/UX Development (if applicable):If you are building a front-end application for AEPS, partnering with Noble Web Studio a leading AEPS software development company is crucial, as their developers have extensive experience in creating intuitive and user-friendly interfaces.

- Testing and Quality Assurance:Thorough testing in a sandbox environment is essential before deploying AEPS functionality to a live production environment. Developers should be adept at testing and debugging.

Where to find AEPS API developers:

- Best Affordable Developers Provide: Websites like Noble web studio can connect you with experiance and affordable developers specialized in Aeps API integration and financial technology.

- Software Development Companies: Noble web studio specializing in fintech or Aeps API development can provide dedicated teams or individual developers for your project.

Read Blog : AEPS API for Cash Withdrawal, Balance Inquiry, and Fund Transfer

Choosing the Right AEPS API Provider

Noble web studio is the right AEPS API provider, prioritize regulatory compliance and security by verifying NPCI and RBI certification and checking for robust security measures like encryption and multi-factor authentication. Evaluate the Noble web studio reliability and performance, looking for high transaction success rates and minimal downtime. Additionally, consider factors such as ease of integration, scalability, transparent pricing, multi-bank support, and 24/7 customer support.

Security and compliance

- NPCI and RBI certification: Ensure the Noble web studio is certified by the National Payments Corporation of India (NPCI) and follows Reserve Bank of India (RBI) guidelines.

- Robust security: Look for Noble web studio that use strong security measures, such as end-to-end encryption, secure authentication, and fraud detection systems.

- Data handling: Confirm that the Noble web studio does not store customer biometric data on its servers, as this should be handled securely by UIDAI.

Reliability and performance

- High success rates: Choose a Noble web studio with a proven track record of high transaction success rates and minimal errors.

- High uptime: Ensure the Aeps API has a stable infrastructure and high uptime to guarantee uninterrupted service.

- Fast transactions: Check for quick transaction processing speeds for a better user experience.

Integration and features

- Seamless integration: Select an top Aeps API that is well-documented and integrates smoothly with your existing systems, such as mobile apps or point-of-sale (POS) devices.

- Scalability: The free Aeps API should be able to handle increased transaction volumes as your business grows.

- Multi-bank support: A wider network of bank support provides greater flexibility for your customers.

- Value-added services: Noble web studio may offer additional services like mobile recharge, bill payments, or Micro ATM integration.

Cost and support

- Transparent pricing: Understand the complete cost structure, including licensing fees, transaction charges, and commission structures.

- 24/7 customer support: Reliable and responsive technical and customer support is crucial for resolving issues quickly and minimizing downtime.

Reputation

- Research and reviews: Read customer reviews and testimonials to gauge the Noble web studio service quality, responsiveness, and overall customer satisfaction.

Why Noble Web Studio Is the Best AEPS API Provider in India

Noble web studio is the best AEPS API provider in India depends on individual needs, but top contenders are often praised for features like robust security, high transaction success rates, fast and reliable processing, seamless Aeps API integration with clear documentation, and competitive commissions. Key factors to consider when choosing a Noble web studio include compliance with regulations like those from the NPCI and RBI, 24/7 customer support, a user-friendly interface, and multi-bank compatibility.

Key factors for choosing an AEPS API provider:

Security and compliance:

- The Noble web studio must be compliant with regulations from the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI).

- Look for features like biometric authentication, strong encryption, SSL protection, and two-factor authentication to ensure secure transactions.

Performance and reliability:

- A high transaction success rate and low failure rates are critical.

- The Noble web studio should offer fast, real-time transaction processing with quick settlement times.

Integration and support:

- Seamless API integration: The Noble web studio should offer well-documented Aeps API that are easy to integrate into your existing application.

- 24/7 Customer support: Responsive technical and customer support is essential for resolving issues promptly.

Features and user experience:

- User-friendly interface: The Aeps platform should be intuitive for both agents and customers to minimize errors.

- Multi-bank support: The ability to connect with a wide range of banks offers greater convenience to a diverse customer base.

Business and revenue model:

- Competitive commission structure: Compare commission rates to maximize earning potential.

- Scalability: The platform should be able to handle a large volume of transactions and scale with your business growth.

- Transparent reporting: A robust Aeps admin panel should provide clear, real-time earnings reports.

Read Blog : How Much Does AEPS API Cost in India? A Complete Guide

Future of AEPS API Technology

The future of AEPS API technology is centered on deepening financial inclusion through advanced security, broader service integration, and enhanced accessibility. Advancements in AI, biometrics, and blockchain are expected to improve the system’s efficiency and integrity, driving its continued growth, particularly in rural and semi-urban areas.

Key trends in AEPS API technology

Enhanced security and fraud detection

- Advanced biometrics and eKYC: Authentication will move beyond simple fingerprint scans to incorporate more sophisticated biometrics, such as facial and iris recognition. This will be coupled with more robust electronic Know Your Customer (eKYC) processes for seamless user verification.

- AI and machine learning: AI-powered fraud detection will become more sophisticated. It will analyze transaction patterns in real-time to identify and prevent suspicious activities, making the system more secure for both consumers and businesses.

- RBI regulations: Following the Reserve Bank of India’s (RBI) stricter monitoring rules from 2026, AEPS platforms will implement more rigorous technical controls to curb fraudulent activities and improve overall payment security.

- Blockchain integration: Some AEPS APIs may adopt blockchain technology to increase transaction transparency and security by creating a tamper-proof ledger. This will further build trust in the system.

Broader service integration and expansion

- Multi-service platforms: AEPS APIs will evolve from offering basic cash withdrawal and balance inquiries to enabling comprehensive digital hubs. These will include services like utility bill payments (BBPS), mobile recharges, and micro-loan repayments.

- Deeper integration with the digital ecosystem: Integration with existing digital wallets and the Unified Payments Interface (UPI) will become more seamless. This will create a unified ecosystem, expanding the user base to include more tech-savvy urban customers.

- Embedded finance: The AEPS API integrated into non-financial platforms, such as e-commerce websites and service apps. This will make financial services accessible within the applications customers use every day.

- Cross-border payments: Future innovations could lead to AEPS integration with cross-border remittances, potentially enabling international money transfers.

Improved user experience and accessibility

- Mobile-first solutions: With rising smartphone adoption, AEPS API software will increasingly focus on mobile-friendly interfaces and apps. This makes services more accessible and user-friendly for both agents and customers, especially in rural areas.

- Voice and SMS-based transactions: To address accessibility issues for users with limited digital literacy or access to advanced technology, AEPS API may support transactions initiated through voice commands or simple SMS messages.

- Offline capabilities: Noble web studio are developing offline transaction capabilities that can be synced later when connectivity is restored. This addresses a major challenge in remote areas with poor internet infrastructure.

- Real-time settlements: Faster and more efficient real-time transaction processing will become a standard feature, improving the user experience and increasing operational efficiency for businesses.

Challenges and opportunities

Opportunities

- Deepening financial inclusion: By making banking services accessible and convenient, AEPS will continue to be a powerful tool for bringing unbanked and underbanked populations into the formal financial system.

- Empowering agents and retailers: The evolution of AEPS API offers retailers the chance to become comprehensive financial service providers. This creates new revenue streams, increases foot traffic, and boosts their overall business growth.

- Enhanced government disbursements: AEPS technology is crucial for the transparent and efficient delivery of government benefits and subsidies directly to beneficiaries’ bank accounts.

Challenges

- Security risks: The increasing sophistication of AEPS API must be matched by equally robust security measures to protect sensitive biometric data and prevent fraud.

- Infrastructure gaps: While offline capabilities are being developed, consistent internet connectivity remains a challenge in many rural areas. This can impact the reliability of the system.

- Lack of awareness: In some rural regions, a lack of awareness and education about AEPS and digital banking can hinder wider adoption. Awareness campaigns are needed to build user trust and confidence.

- Dependence on Aadhaar: The AEPS system relies heavily on the Aadhaar infrastructure. Any issues or policy changes related to Aadhaar could impact AEPS functionality.

Conclusion

In today’s digital payment era, adopting AEPS API integration is one of the smartest moves for startups and businesses aiming to grow in 2025. It allows companies to offer secure, instant, and Aadhaar-based transactions that build customer trust and simplify financial operations.

An AEPS API, or Aadhaar Enabled Payment System Application Programming Interface, is a set of tools that allows businesses and developers to integrate basic AEPS Banking Software services into their own applications. By using a biometric device and a customer’s Aadhaar number, these services can be offered at points of sale like a micro-ATM, primarily to provide financial access in rural and unbanked areas.

Noble web studio is the top AEPS API provider, you can manage multiple services like balance inquiry, cash withdrawal, and fund transfers from a single platform. This not only improves efficiency but also helps businesses earn more commission and increase customer satisfaction.

For startups and retailers, AEPS API solution open the door to new revenue opportunities and scalable digital services. Partnering with an experienced company like Noble Web Studio ensures smooth integration, strong technical support, and complete compliance with payment standards.

If you’re ready to expand your fintech business in 2026, now is the best time to integrate AEPS API and take your business to the next level.

FAQs – AEPS API Guide 2026

AEPS API (Aadhaar Enabled Payment System API) is a digital payment solution that allows users to make secure and instant transactions using their Aadhaar number and biometric verification. It helps startups and businesses offer easy cash withdrawals, balance inquiries, and fund transfers directly through bank accounts.

AEPS API enables startups and retailers to earn commissions on every transaction, attract more customers, and provide essential banking services without heavy investment. It’s a great way to expand digital payment services and increase revenue.

Yes, AEPS API is completely secure and regulated by NPCI (National Payments Corporation of India). It uses biometric verification and encrypted data to ensure every transaction is safe and reliable.

Key features include real-time transactions, multi-bank support, user-friendly dashboards, detailed reports, and high uptime. These features help businesses manage digital payments easily and efficiently.

Businesses can integration AEPS API by partnering with a trusted AEPS API provider like Noble Web Studio. The integration process includes Aeps API setup, KYC verification, and testing before going live to ensure smooth and secure operation.

Absolutely. Every successful transaction, such as withdrawals, balance checks, or fund transfers, earns a commission for the retailer or agent. It’s one of the most profitable digital payment models for local businesses.

AEPS API helps businesses offer banking services in rural and urban areas, increase customer trust, and generate additional income. In 2025, AEPS is expected to play a key role in digital financial inclusion across India.

Noble Web Studio provides secure, scalable, and easy-to-integrate AEPS API solutions for startups, retailers, and fintech businesses. With expert support, real-time analytics, and smooth setup, they help you grow your business and earn more commissions.